Pre-Procurement

Introduction

Public-private partnerships depend on a long-term collaborative relationship between a public agency and a private firm. They often require some rethinking of the governmental agency’s essential functions. Agencies that succeed with P3s have a business mindset, a clear vision about what they want to achieve and why they want to use a P3. Additionally, they have made an honest assessment of what is needed to accomplish those goals in a manner that provides best value for their ratepayers.

Identifying and developing a good P3 typically involves a series of progressively more detailed and resource-intensive tiers of analysis and planning. With each tier, the definition and goal for what constitutes a good P3 evolves, so owners should advance to subsequent tiers only if project intentions and goals continue to be met.

- 1. Criteria for success

- 2. Know what is legal

- 3. Begin planning with the end in mind

- 4. Conduct a resource requirement review

- 5. Plan for data collection

- 6. Develop a management method

- 7. Conduct a project assessment

- 8. Anticipate human deployment

- 9. Plan on building P3 awareness and consensus

- 10. Conduct high level screening

- 11. Build the business case for the decision makers

- 12. Assess project size, scope and feasibility

- 13. Build a plan for stakeholder engagement

- 14. Commit to thorough and broad communication

- 15. Identify prospective project attributes

- 16. Technical and financial analysis

- 17. Refine, create a model and allocate risk

- 18. Final thought

If you haven’t already done so, this would be a good time to peruse the dedicated page for Water Toolkit Topic 1 – Planning, to have in mind when proceeding with planning.

TOP 10 CRITICAL ISSUES to consider when planning a procurement.

Most states have procurement laws and regulations that control what project delivery methods are legal in their state. Additionally, they may require public agencies to take certain specific steps prior to, or during the procurement .

Public owners need to know what they can and cannot do regarding private sector communications before and during a P3 procurement. Additionally, P3s may need to comply with IRS Safe Haven rules and laws for investment bankers, banks, equity investors, bond issuers, public disclosure, confidentiality, etc. Many states have regulations on communications with possible bidders during different phases of procurement, and owners are encouraged to check with their state or local contracting offices.

For additional details, see Water Toolkit Topic 4 – Legal.

Project definition

Any successful project requires a well-defined project scope. In addition, defining associated minimum performance requirements, key performance indicators, contract terms and project risks are important to the success of the project. The long-term contractual relationships of P3 projects make this even more important.

Up-front costs should be determined when deciding on project structure. Life cycle savings and overall value during the procurement process of each structure must be weighed, and the option that provides the maximum value for money should be chosen. In certain circumstances a project can finance these P3 planning costs through the project delivery process, by requiring the private sector contractor reimburse these costs.

These questions should be answered to define the project:

- What should the P3 partner do? DB, DBF, DBFOM? This addresses scope.

- Over what period of time? Schedule.

- Benchmark that schedule. Is it typical for similar P3s?

- What are the key performance metrics?

- Quality

- Capacity

- Performance, sustainability, reliability

- O&M costs

- What are the project’s inputs? (e.g., raw water quality, wastewater influent loadings, flow, power, chemicals, etc.)

- What are the project’s outputs? (e.g., finished water quality, permitted effluent limits, flow, energy, reuse water, district heat, biosolids, etc.)

Risk management

Determine anticipated risk management by identifying project key risks and considering their:

- Consequence

- Severity

- Probability

- Impact

- Strategy to mitigate. Desired risk transfer.

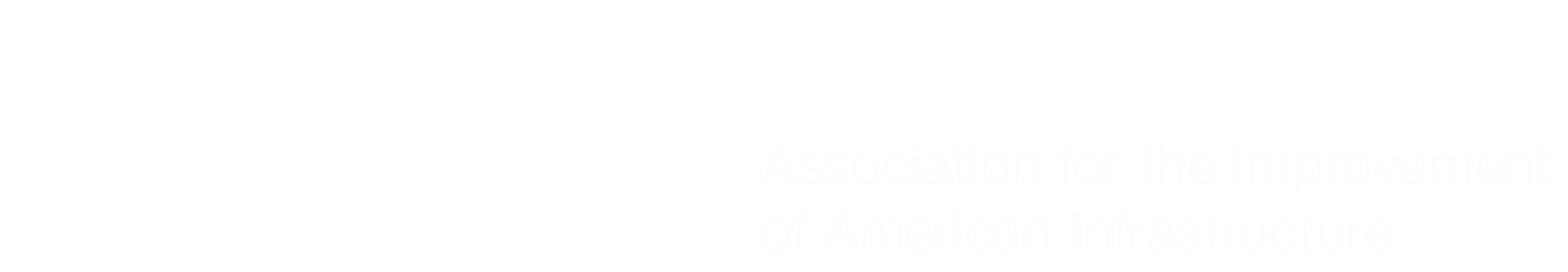

The value of a P3 is that the public agency and private partner are able to work together to address the appropriate transfer of risk to the party best suited to mitigate it. This is essentially the basis of the Value for Money (VfM) proposition; that having a private counterpart assume a project risk has an actual tangible value.

Preliminary Capex or Life-cycle cost estimate.

Life-Cycle Costing Analysis: Mandatory for all Infrastructure Projects

Girish M Ramachandran on LinkedIn

Publish date May 12, 2017

Determine needs

- Engineer/design criteria professional – expertise in performance contracting

- Financial – experience in project finance, modeling, financial risk mitigation and commercial terms

- Legal – expertise in P3 commercial terms and risk mitigation

- Assess agency’s competencies, attributes and staffing in meeting the needs –

- Determine available internal resources and skills within the agency that can be drawn upon.

- Determine existing agreements and contracts with advisors.

- Based on a resource gap analysis, determine needed external resources.

- Advisors

Agencies planning a P3 should use quality advisors. Engaging specialized procurement, technical, legal, financial, insurance, public relations, and communications advisors to provide guidance and supplement the in-house expertise is suggested, particularly early on. Advisors should have relevant experience in the delivery of comparable projects and contractual structure to maximize the delivery method’s utility and cost-effectiveness to effectively guide the agency in the process.

TOP 10 QUESTIONS TO ASK YOUR ADVISOR

BUILDING A QUALITY PROJECT – ADVISORS

In order to define and communicate the project scope, the technical team will need to collect and draft documents. A system should be developed to collect data and share project data including information on the system, rates, and costs , usage, income, expenses, liabilities, debt. Once compiled, the agency can determine if more information is needed, which, if so, should be obtained in the form of studies and surveys in order to provide the proposers with reliable data driven information.

The technical team should establish a process for drafting technical provisions; assigning responsibility for individual sections to staff or advisors with the relevant expertise, selecting an individual with the responsibility of compiling the specifications into a set of provisions defining the project scope.

In order to maintain satisfied stakeholders, there are key areas that you need to address: engagement, management and how to address concerns.

An organized and systematic approach will be beneficial to ensure that you have appropriately identified your stakeholders and created a plan to manage communications and expectations, resolve challenges and meet your project goals.

Conduct a project assessment to identify P3 delivery method options:

- Identify repayment mechanism. Can the project generate enough revenue to be a viable P3?

- Perform value for money study to determine if a P3 structure can provide additional value to the project.

- Identify risks and appropriate mitigations during construction and O&M.

- Select appropriate structure based on value for money, funding, and risks (DBB, CM/GC, DB, DBF, DBFM, DBFOM).

Identify the agency project manager & team that will manage and carry through the P3 process. It is not unusual that the project manager & some team members may be external.

Team membership to be considered:

-

- P3 champion

- Management team/board

- Independent peer review

- Project manager

- Procurement advisor with expertise in making P3s effective, developing solicitations and solving client issues. This can be internal or external.

Get key stakeholders on board with delivery method evaluation for the project.

- Recognized public figures should serve as the agency’s spokespersons and advocates for the project and the chosen procurement delivery model

- Well-informed champions can play a critical role in minimizing misperceptions about the value to the public of an effectively developed P3

- Confirm the P3 project goals are still pertinent (adjust as necessary)

- Reconfirm the project’s definition.

- Review the project’s revenue stream and cost.

During this stage, it is important to revisit the project goals and definition and confirm that your prior feasibility and screening assessments are on track.

The business case starts with the project description and is built out with the inclusion of project components:

estimated construction and life cycle costs

timeline for development

proposed financing plan

projected revenues (public or private, debt and equity investments)

context of project related to existing capital strategic plans

permits and process approvals (local, county, state and Federal permits and environmental reviews)

statement of risks, liabilities and responsibilities (allocated and retained)

The purpose of the business case is to clearly demonstrate and build an understanding of P3 opportunities and issues for the executive team, governing board or council members.

SAMPLE BUSINESS CASE

Develop tools for the assessment and evaluation and comparison of the proposed projects costs and benefits; public sector cost comparison, business case analysis, comparison of financial and non-financial benefits, alternatives analysis (value for money), and summary of benefits to taxpayers, rate payers or other users of the proposed infrastructure asset.

SAMPLE VfM

- Make a determination of the best value project delivery method

- Conduct project assessment & selection of the preferred P3 delivery method

- Identify and develop your broader stakeholder base.

- Plan to communicate the initiative with your employees, the public receiving the service, the press, appropriate labor unions and relevant interest groups. They will all have opinions and may have misconceptions about a partnership and its value to the public.

- Project success depends on understanding and engaging those entities, individuals and organizations that have an interest in the community or are touched by the project. Therefore, spending time up front to determine who your stakeholders are is an important step in planning for project success.

- Identify the stakeholders.

- Identify what they are likely to be focused on.

- Be transparent and genuine in your communications and listen to your tax payers’ concerns

- Address concerns and consider accommodations that can be put in place without jeopardizing project goals.

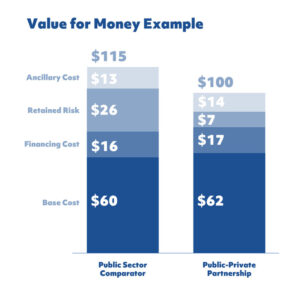

Communication is one of the most critical things for a project to be successful, and this especially true for a P3 project, given that it might be delivered in a way that is unique or different to that which the organization or the jurisdiction is accustomed. It is not enough to just follow the kind of processes required in the traditional project delivery process as far as stakeholder outreach and engagement. It is important to sit down and analyze. Initially during the high-level screening start with asking who are the internal agency stakeholders? Determine who within the agency and organization will be key to making a P3 decision and also ask who else outside of the agency? Determine if it is the mayor’s office, the governor’s office or other elected officials that will be essential to the decision process at various points throughout the procurement process.

It is important to understand what their motivations will be and how interactions will occur through the process as well as communicate and educate to bring people on board.

During the preliminary procurement planning it will be necessary to identify external stakeholders. Stakeholder engagement is an important element throughout the whole life cycle of the project.

QUESTIONS TO ASK YOURSELF

Who will be impacted by this project?

What is important to them?

As a subset to thorough and broad communication, plan industry outreach. Request Information, market sounding, one-on-one meetings.

What methods of industry outreach will be needed?

Building vendor interest in a P3 project is necessary for the project to be a commercial success, and the public owner has many options for outreach and communication. The traditional route might take the public agency down a path of a Market Sounding, an issuance of a Request for Information (RFI), Industry days, one-on-one meetings, and stakeholder focus groups, or charrettes. More recent options include social media outreach and direct communication at national P3 focused events.

SAMPLE RFI

Once the agency makes a preliminary decision to use P3 project delivery, conduct an Industry Day or Market Sounding.

It is desirable to get reliable industry feedback as early as possible on high-level features and attributes of a P3 project and the procurement process. Where permissible by law, agencies can conduct a Market Sounding or hold an Industry Day and potentially provide a preliminary project description, term sheet, risk matrix, or summary of key deal points prior to commencement of a procurement. This level of insight will save time and money once the procurement process begins. It can be important to separate project specific items from P3 or industry specific ones.

The key initial considerations for the industry market sounding will be:

Is this project real?

Is it worth it?

Are the objectives sound?

Project size and scope

Does the size of the project warrant and support private investment? Is the scope of the project realistic and the risk allocation reasonable for the industry? Private project financing closing costs can be substantial; some financing participants in the market have a minimum dollar threshold for participating in P3. Is there an identified and reliable revenue stream for the entirety of the project term?

Urgency or priority of the project for the community and government

How important is this project to the agency’s success? Is it in the Capital Improvement Plan, and is it well considered? What is the impact on the community if it is built and operational, or not? In addition to a demand for the project, is there strong opposition? What are the realistic alternatives?

Complexity of the project

How complex is the project compared to other similar projects? How complex is the project compared to other projects undertaken by the procuring government? Is there an opportunity for private sector innovation?

Anticipated project duration or term

Is there a standard term (time period) for similar projects? Is there comfort for the public for a project term? Is there a comfort level for the private sector for a project term in relation to financing or operations and maintenance including the replacement of major equipment especially special equipment before handback.

Detail the potential project

Additionally, and only if allowed by law, provide a preliminary project description, term sheet, risk matrix and/or summary of key deal points.

Market Sounding preparation should focus on addressing the above considerations. Seek the markets thoughts, input, and concerns as part of the interaction. Don’t go into Market Sounding until the project and schedule are as firm as possible – know what is being asked before asking private firms to start spending significant money to pursue a P3 project.

Industry reviews and input are critical during the early stages of any project, but even more so for a P3. This input is essential to ensure a project that captures the interest of proposers is viable. Otherwise, one could be six months down the road before determining nobody can or will propose on the project.

SAMPLE MARKET SOUNDING PLANS

Developing the P3 solicitation

Now is the time, while working with your advisor, to review and update the Value for Money, as well as finalize and prepare solicitation for release.

Refining the project definition, creating the competitive model and allocating risks

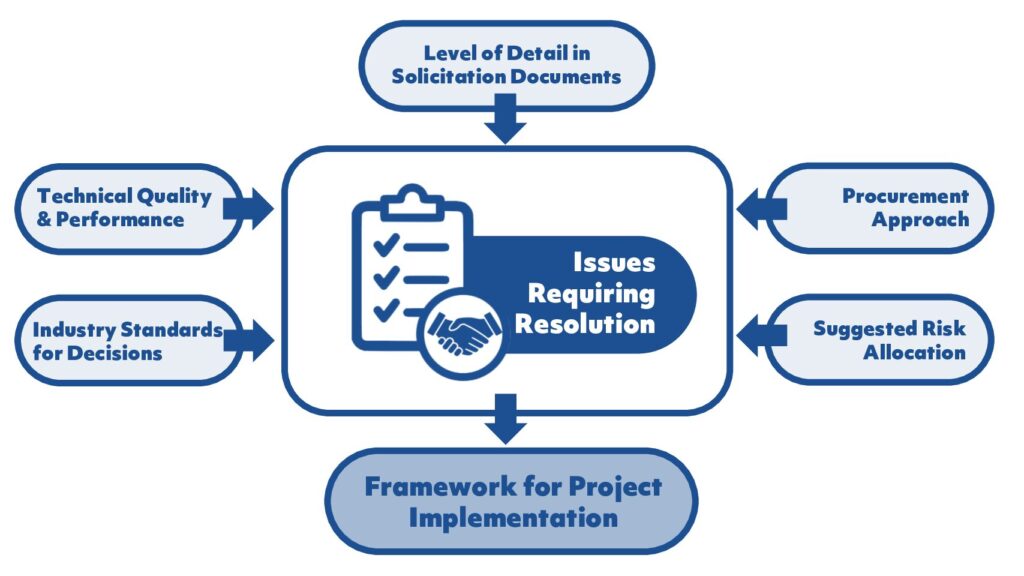

After having made the decision to proceed with a P3 project delivery, it is necessary to refine the project scope and associated performance requirements and measures, establish the competitive model for the procurement and begin to assess risks and develop a contract that fairly allocates risk. The figure below suggests elements for consideration when refining the project:

Develop as detailed a description and/or picture of the project utilizing the work done in “Project Description” of the planning process discussed above with project details and cost information to the extent possible. To refine the scope requires a technical analysis that focuses on the next most important level of details that will define the P3 project. The owner will need to answer questions such as:

- What requirements does the public owner want to enforce? (Performance, footprint, capacity, functionality, community integration, equipment, turnover condition, etc.)

- What requirements can the public owner delegate to the private partner? (treatment technologies, size of individual units, layout, finishes, etc.)

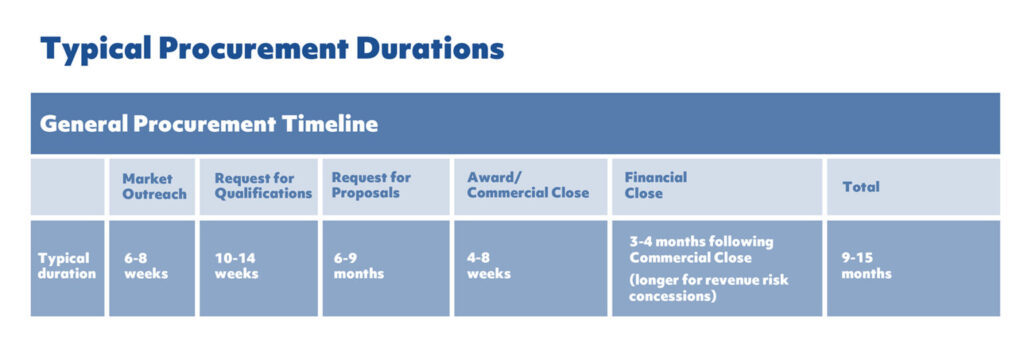

It is generally best to use a two-step (qualifications-based) procurement. It cannot be stressed more; selecting the correct private partner is the most important factor in a P3 project’s success. Consequently, a frequently used procurement for a P3 involves a Requests for Qualification (RFQ) first, followed by a Request for Proposal (RFP). An RFQ identifies the project by using the Project Definition developed and requests teams to submit their qualifications (team members, relevant experience, financial strength). Typically, thereafter the sponsoring agency will use the RFQ submittal to select 3-4 Pre-Qualified teams to continue in the P3 solicitation who will receive the RFP. A candidate’s past performance, relevant experience in P3s is an important factor in identifying the right partner. Additionally, the financial capacity of the private partner is also a factor.

An RFP typically has a more detailed Project Definition, may include a conceptual design, and has clear performance requirements. The RFP typically has very clear information requests, an Identification of the process and criteria or factors for proposal selection and a pricing submittal format. Often, as risks cannot be completely priced in the absence of commercial terms and conditions a draft contract is provided. Generally, there is a some form of engagement process defined where the sponsor agency and the proposing teams can submit questions and receive answers. Allowing the teams to provide feedback on RFP documents frequently provides input that saves them time and uncertainty, and which saves the sponsoring agency money. Often this process involves one-on-one or in-confidence meetings between the sponsoring agency and its advisors, and the proposal team and its advisors. The objective of the engagement process is all parties are as clear as possible on what asset is needed and how the risks are to be managed.

Most P3s are based upon a “Best Value” team selection. A best value is not necessarily the lowest price. More importantly, it values the technical and commercial solutions offered and the long-term relationship that is central to a successful partnership.

Questions to ask:

- Is the timeline commercially sound?

- Are the performance characteristics for the project sound?

- What are the historic performance levels for such projects?

- What are the desired performance characteristics for this project? What does success look like?

- Who benefits?

- How much support?

- What is the value to the public?

- Is it affordable? Do the numbers make sense?

- What stakeholders may find this approach objectionable and have answers been prepared for their likely objections?

- What are the known or anticipated risks associated with performance objectives?